I thought I was managing my rentals the right way… until I saw my tax bill

A couple years ago, I was knee-deep in managing my properties.

Booking cleanings. Coordinating vendors. Fixing stuff.

You know — the real landlord life.

So when tax time came around, I figured I’d at least see some kind of break.

Nope. Still got hammered.

That’s when a friend casually asked,

“Have you ever looked into Real Estate Professional Status?”

I had heard of it, kind of. Thought it was for full-time brokers or agents.

Turns out, it’s not. It’s for people doing exactly what I was doing — just without the tracking.

What Is Real Estate Professional Status (REPS) — and Why It Matters

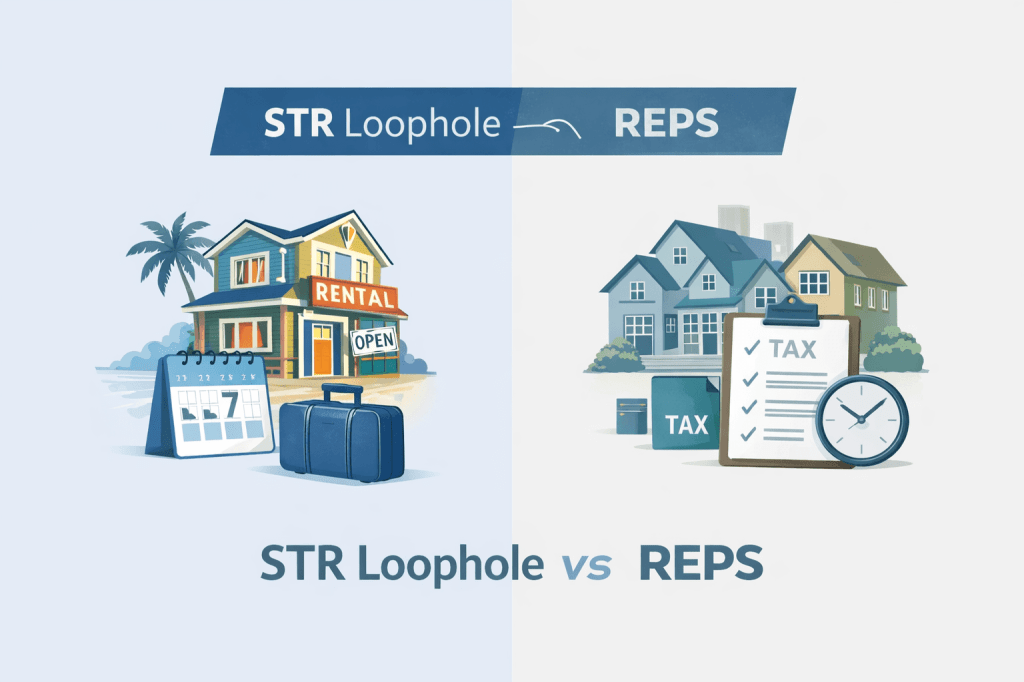

Real Estate Professional Status (REPS) is a tax classification that allows certain real estate investors to treat their rental losses as active, not passive.

Normally, real estate losses — like depreciation, maintenance, and interest — can only be used to offset passive income (like rental cash flow). But most investors don’t have enough passive income to make that worthwhile.

If you qualify for REPS, you can use those “paper losses” to offset your active income — like your W-2 job, freelance work, or business profits.

And yes — that can mean saving $10K, $15K, or more in taxes every single year.

How to Qualify for REPS (And Meet the IRS Requirements Without Stressing)

There are three main REPS IRS requirements to qualify:

1. 750 Hours Rule

You must spend at least 750 hours per year on real estate activities that relate to properties you own

2. More Than 50% Rule

More than half of your total working time must be in real estate trades or businesses.

3. Material Participation Requirement

You must be actively involved in managing your properties — not just an investor.

🔍 Important: If you’re married and file jointly, only one spouse needs to qualify.

So if you’re showing units, talking to tenants, managing repairs, and doing the books — you’re probably doing the work already. The only question is: can you prove it?

What Hours Count Toward REPS — and Which Ones Don’t

✅ Hours That Do Count Toward REPS:

- Managing or supervising your rental properties

- Time spent on lease renewals, listings, and marketing your units

- Handling tenant communications or issues

- Coordinating or overseeing repairs, maintenance, or renovations

- Screening tenants or showing units

- Traveling only if it’s directly tied to an active rental task

- Research and due diligence tied to a specific property you’re actively acquiring

❌ Hours That Don’t Count:

- Browsing Zillow or analyzing deals without a real plan to purchase

- Education, networking events, or general real estate reading

- Time spent managing other people’s properties or syndications

- Admin tasks that don’t relate to your own rentals

- Passive investment activities where you’re not materially involved

A lot of time gets overlooked — but if you’re actively managing your rentals, you might already be close to (or over) the 750-hour threshold. The trick is keeping good records.

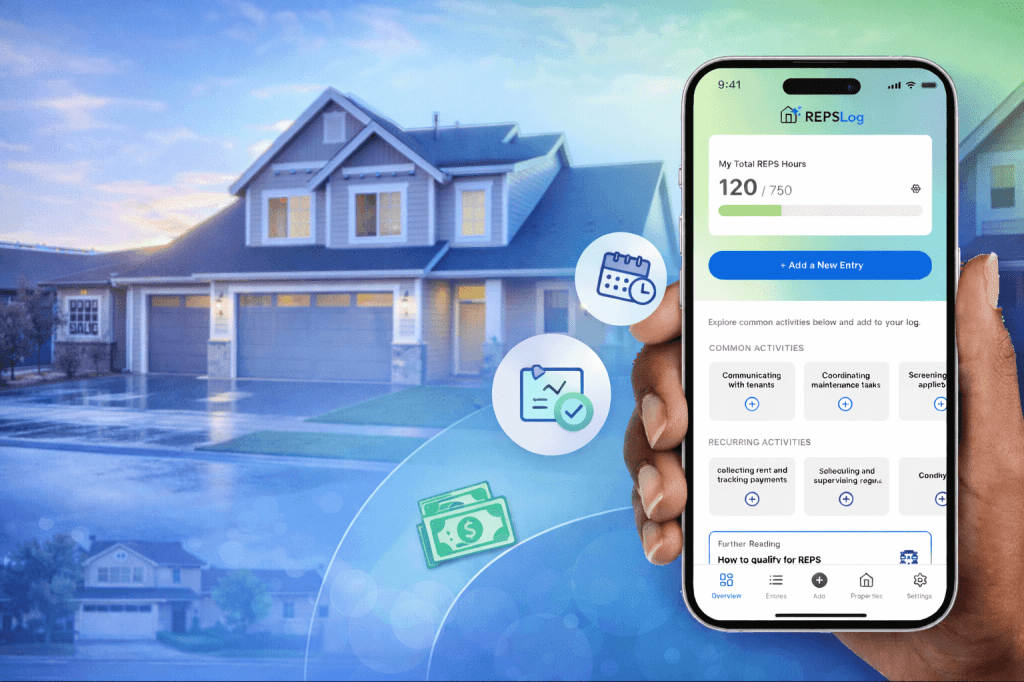

The Fastest Way to Track REPS Hours

I started with spreadsheets, but trying to manage them on my phone was a pain. Typing everything out, re-entering the property address in every row, and not being able to upload photos made it feel clunky and frustrating. I’d fall behind or skip entries altogether.

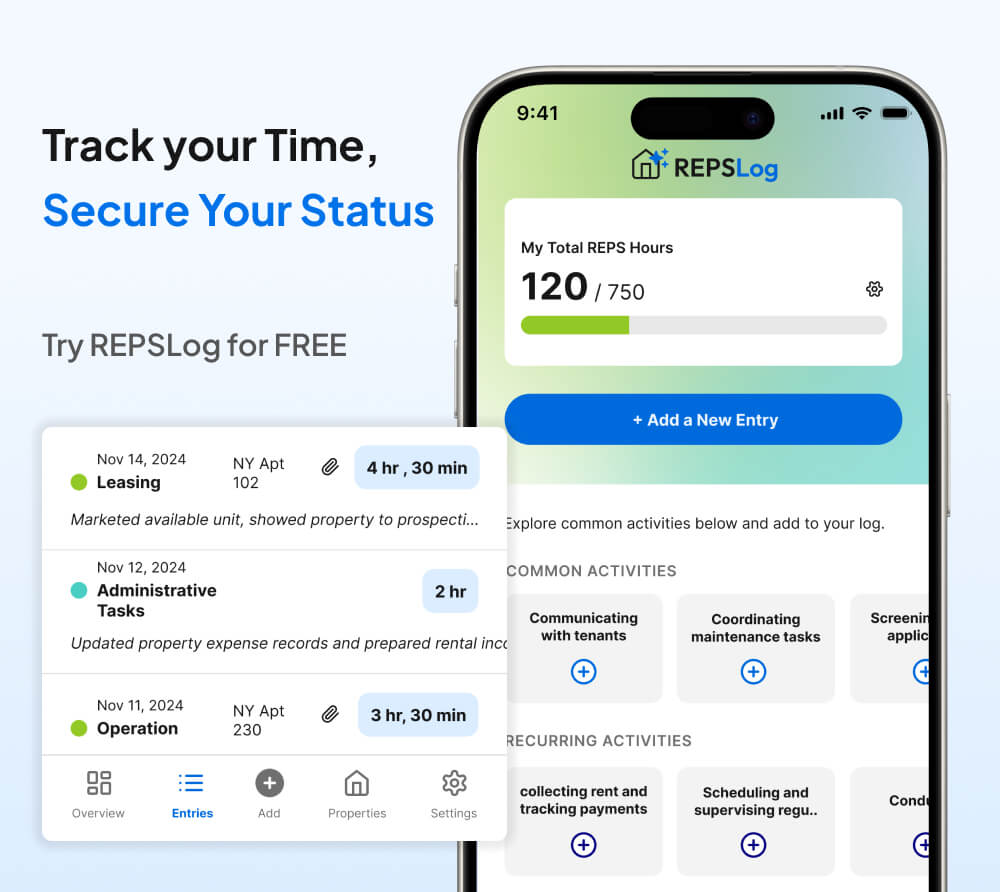

I eventually switched to REPSLog, and it’s been way easier. I just speak into my phone — something like “Prepared lease renewals for my Wilshire property” — and it logs the entry automatically using speech-to-text and autofill. Takes less than 15 seconds.

It’s made tracking my REPS hours feel less like a chore, and more like something I can actually keep up with.

What This Could Be Worth

Let’s say you made $125,000 this year from a W-2 job or your business.

You also own a few rentals that show $30,000 in paper losses.

If you don’t qualify for REPS:

That $30K just hangs out. Maybe helps offset other passive income — or gets carried forward.

If you do qualify for Real Estate Professional Status:

That $30K gets deducted directly from your active income. Boom — now you’re taxed on $95K instead.

That’s real cash saved — not someday-maybe benefit. Real now-money.

Final Thoughts

I used to think tax savings came from hiring a good CPA or maxing out my retirement accounts.

But sometimes, it’s about slowing down and asking:

“Am I already doing work that the tax code rewards?”

REPS isn’t some rich-person trick.

It’s in the IRS rules. You just have to know about it — and track your hours.

If you’re managing rentals yourself, it’s worth a look.

And if you’re like me and forget what you did yesterday — just let something like REPSLog help you keep track.

It’s not about being perfect. It’s about being consistent — and finally getting the tax break you’ve already earned.

Please Note: REPSLog is NOT a lawyer or CPA, and this is not legal or financial advice. Please consult a qualified professional for guidance regarding IRS rules and regulations.