Let me start by saying: I wish someone had told me about cost segregation the moment I bought my first rental.

If you’re a real estate investor who qualifies for Real Estate Professional Status (REPS) or uses the Short-Term Rental (STR) loophole, this strategy might be your new best friend.

It’s one of those not-so-secret weapons that the wealthy have been using for decades — and it’s 100% legal.

So let’s break it down in plain English.

What Is Cost Segregation?

Cost segregation is a fancy term for something surprisingly simple: accelerating your depreciation.

Instead of depreciating your rental property over 27.5 years (residential) or 39 years (commercial), a cost seg study lets you break the property into parts — some of which can be depreciated over 5, 7, or 15 years.

That means way bigger deductions upfront.

Think: appliances, flooring, cabinetry, HVAC, landscaping — all of that stuff can be written off way faster than the building itself.

Building vs. Land Value (This Part Matters)

One important thing to know before you start calculating depreciation: land doesn’t depreciate.

So when you buy a property, only the building and its components can be depreciated.

Here’s where it gets a little technical: the IRS requires you to allocate part of your purchase price to land and the rest to the building.

So how is that split done?

- In most cases, your county assessor provides a building-to-land ratio on your property tax records.

- In many states, it’s common to see 80/20 or 85/15 (building/land).

- But in high-priced areas (like California or Hawaii), land can take up a bigger chunk — sometimes 40% or more.

- Your CPA or cost seg provider can help you justify a reasonable allocation based on local data and comps.

Bottom line: only the building portion goes through cost segregation. The higher that portion is, the bigger your potential deduction.

Real-Life Example (Because Math Helps)

Let’s say you buy a short-term rental for $500,000 total.

Your tax records show 80% building, 20% land:

- $500,000 × 80% = $400,000 building value

Without cost segregation:

- You’d depreciate $400,000 over 27.5 years = ~$14,545/year

With a cost seg study:

- Maybe 25% of the $400,000 (aka $100,000) is reclassified into 5- or 15-year assets

- If bonus depreciation applies, that $100K can be written off in Year 1 — but only depending on the year you’re doing this.

For example, in 2022 you could deduct 100% of it ($100K); in 2024, you’d get 60% ($60K); and by 2025, it’s down to 40% ($40K). Unless Congress steps in, bonus depreciation is phasing out — so the sooner you act, the more you can write off right away.

Either way, that’s a much bigger deduction upfront than $14K/year.

This Only Works If You Qualify for REPS or STR Loophole

Here’s the catch — and the opportunity.

To use those big losses to offset your W-2 or other active income, your real estate losses must be non-passive.

That means you need one of these two things:

1. Real Estate Professional Status (REPS)

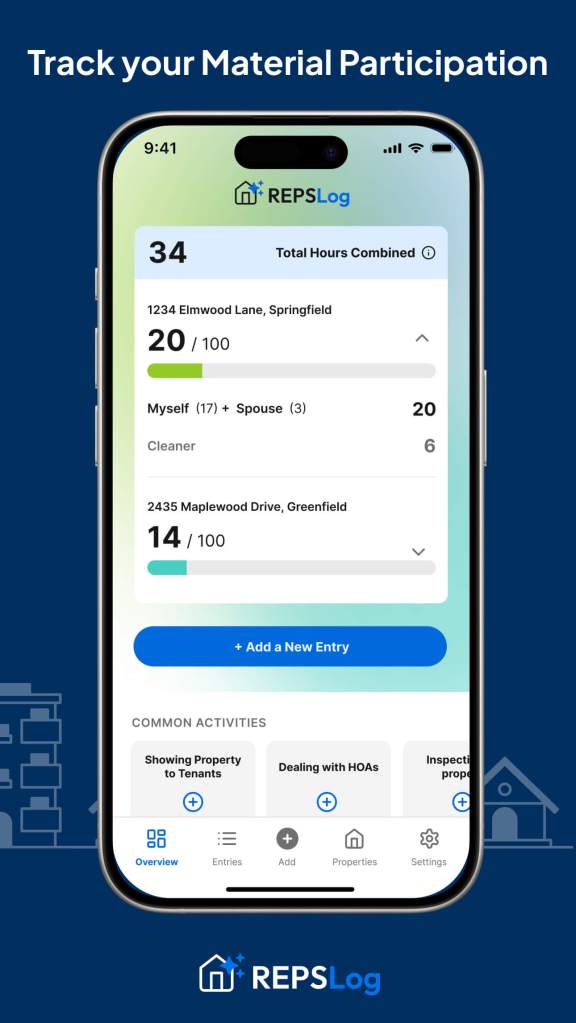

You materially participate in your real estate activities AND spend more time on them than any other job, totaling 750+ hours per year.

2. STR Loophole

If your property qualifies as a short-term rental (average stays under 7 days) and you materially participate (typically ~100 hours/year and more than anyone else), then it’s treated as non-passive even if you don’t qualify for REPS.

If you don’t meet either of these? The loss is still useful — just passive. It gets carried forward until you have passive income to offset.

🔍 What About Audits?

Let’s be real — the IRS knows these strategies are powerful. And that means they’re watching.

If you’re claiming REPS or the STR loophole and deducting large losses (especially after a cost seg study), you better have your records in order.

The #1 thing they’ll ask for? Proof of material participation.

That means:

- How many hours you spent

- What activities you performed

- When you did them

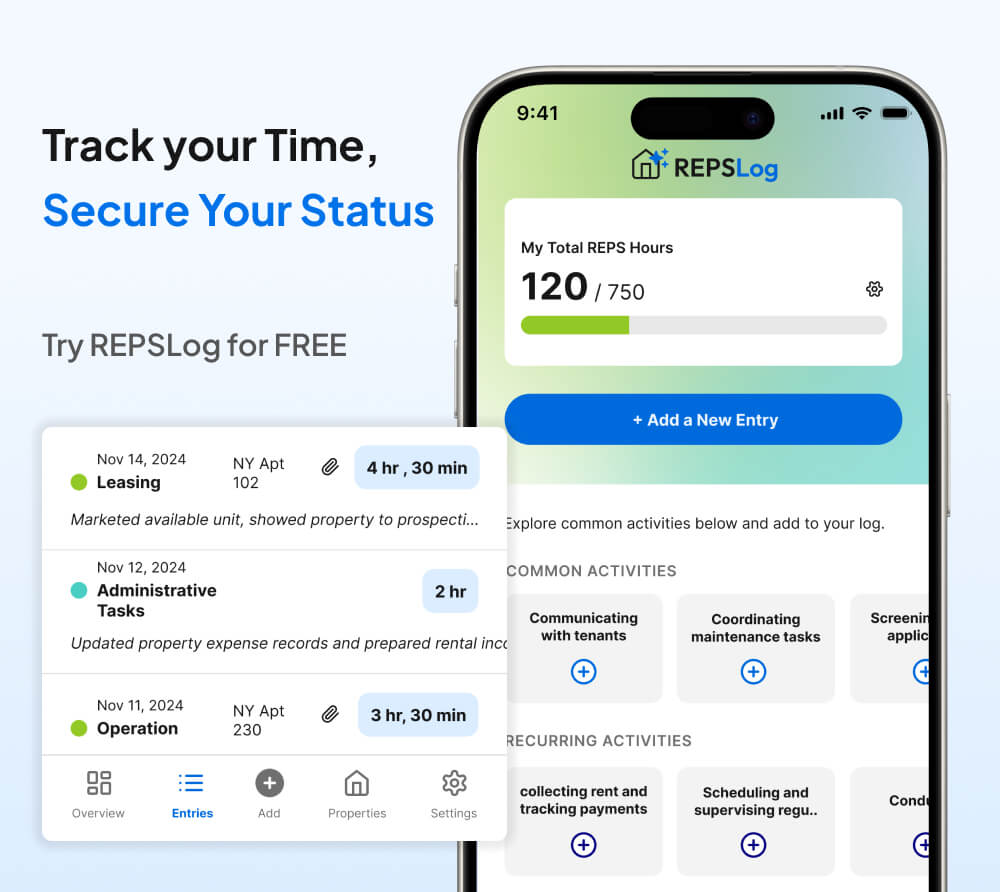

I used to track hours in random notebooks and notes on my phone — not ideal. Now I use REPSLog, which time-stamps every log entry and organizes everything in one place. I can export a clean report if I ever need to prove it.

If you’re using these tax strategies, track your hours like it’s a requirement — because it kind of is.

Who Should Consider Cost Segregation?

You should probably look into it if:

- You own a rental properties

- You qualify (or plan to qualify) for REPS this year or, you’re using the STR loophole and actively managing the property

- You’re expecting high income and want to reduce your tax bill

- You’re planning to hold the property for a while (to avoid depreciation recapture headaches too soon)

My Experience (And What I’d Do Differently)

I used cost seg on my second LTR — right after I realized I qualified for REPS (still wild to me).

The firm I hired handled everything, and the result was a six-figure paper loss.

That loss offset my spouse’s W-2 income, and we saved over $30K in taxes that year.

Looking back, I wish I had done it with my first rental. But hey, live and learn.

How to Get Started

- Talk to your CPA to confirm you’re eligible (REPS/STR).

- Hire a reputable cost seg firm — preferably one that works with small investors and STRs.

- Provide property details.

- They’ll deliver a report you (or your CPA) can plug into your tax return.

- Track your hours with REPSLog to back up your tax position.

Final Thoughts

Cost segregation isn’t just for billion-dollar commercial buildings — it’s for us, too.

If you’re serious about building wealth through real estate and want to pay less in taxes along the way, cost segregation paired with REPS or the STR loophole is one of the most powerful moves you can make.

Just make sure you’re doing it by the book:

- Know your building vs. land value

- Work with pros

- Track your hours like it’s your side hustle

Your future self — and your tax refund — will thank you.

Please Note: REPSLog is NOT a lawyer or CPA, and this is not legal or financial advice. Please consult a qualified professional for guidance regarding IRS rules and regulations.