Let’s be real—if you’re using the REPS or STR loophole to offset your income, you need to understand how the IRS thinks. And lucky for us, they’ve published their internal playbook: the Passive Activity Loss Audit Technique Guide (ATG).

This is the same guide IRS agents use when they audit real estate investors. It spells out exactly what they look for, what counts, what doesn’t, and how they decide whether your hours are legit.

I went through the whole thing and pulled out the stuff that matters most—especially if you’re trying to qualify for Real Estate Professional Status or prove material participation in a short-term rental.

What Is the Passive Activity Loss ATG?

The IRS’s Passive Activity Loss Audit Guide is basically a step-by-step manual for agents reviewing real estate tax filings. If you’re claiming big losses against W-2 income through REPS or STR, this is what they use to figure out if you actually qualify—or not.

Key Takeaways for Real Estate Investors

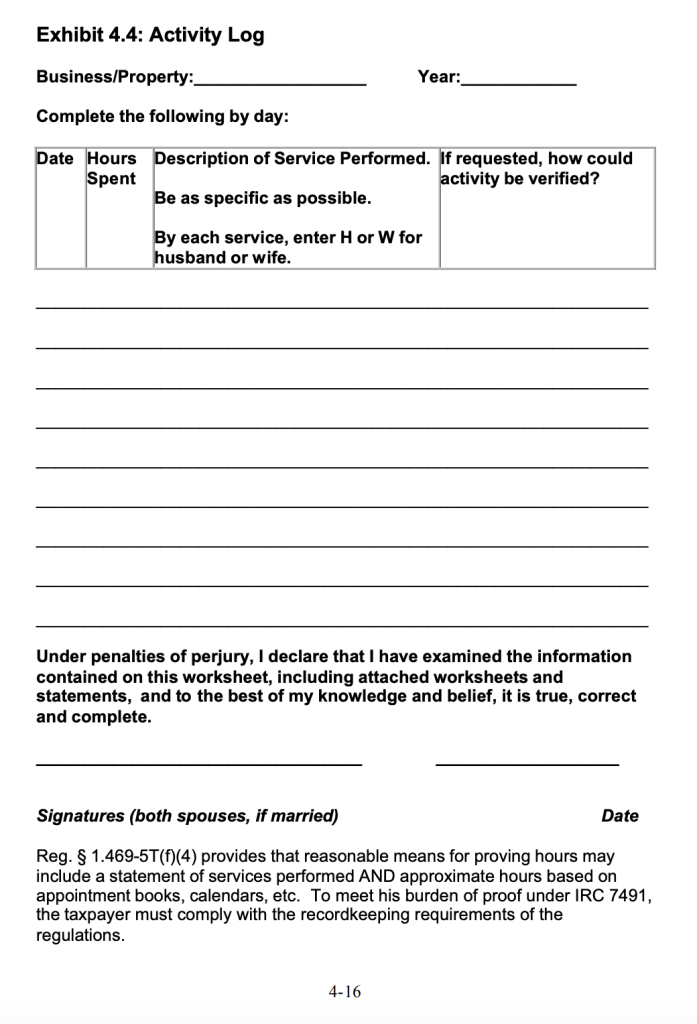

1. The IRS Wants Clear, Detailed, and Real-Time Logs

If your time log is vague, estimated, or created retroactively, the IRS won’t buy it. They’re trained to look for:

- Specific task descriptions

- Dates and durations

- Who did what

- Which property it was for

And they’ll ask, “How can this be verified?” If you can’t answer that, the hours probably won’t count.

2. Not Everything Counts Toward Material Participation

This guide makes it super clear: not all real estate activity qualifies.

Doesn’t count:

- Real estate education (even if it’s amazing)

- Scrolling Zillow or watching YouTube videos

- Travel that’s not tied to work on a specific property

- Investor-only activities with no operations role

Your time needs to be active, hands-on, and directly tied to rental operations.

3. Grouping Is a Big Deal

If you own multiple properties and haven’t filed a grouping election, the IRS will expect you to prove material participation on each property individually. That’s a losing game for most investors.

Once you group, you can track your time across all rentals as one activity. But you have to elect it in writing—and once you do, it sticks unless something major changes.

4. The IRS Uses Yes/No Flowcharts to Test You

They’re not guessing. They’re literally walking through decision trees:

- Did you work 500+ hours?

- Did you work 100+ hours and more than anyone else?

- Did you do substantially all the work?

You need to clearly pass one of the seven material participation tests. If you’re not familiar, you can see the full list here: IRS material participation tests.

5. Proof Is Everything

If your log says “contractor walkthrough,” the agent is going to ask: “Where’s the proof?”

They want:

- Emails with vendors

- Invoices or receipts

- Photos or screenshots

- Calendar invites or messages

The guide literally includes a column in their internal tracker: “If asked, how can this be confirmed?” So yeah, be ready.

6. Grouping Elections Can Be Reviewed

Even if you file a grouping election, the IRS can still review whether your grouping is reasonable. For example, grouping a commercial property with a residential rental that you never touch operationally may raise red flags. It needs to make sense on paper.

7. “Participation” Needs to Be Operational

They’re not just counting hours. They’re looking at what you did. If most of your hours are admin tasks that aren’t critical to the property’s operations, that’s not going to be strong enough. Activities need to be tied to actual business function—not fluff.

8. Third-Party Work Must Be Accounted For

Especially in STRs, the IRS wants to see who else was involved. If you claim 100 hours, but your cleaner or manager worked 150, you’ve got a problem.

That’s why it’s smart to log other people’s hours too, especially if you’re trying to qualify under the “100-hour + more than anyone else” rule.

Real IRS Audit Fails

The guide gives examples of people who blew it:

- Time logs created after-the-fact

- Counting seminars or podcasts as work hours

- Failing to group properties, then not participating enough in each one

- Repeating identical time entries every day (a dead giveaway)

It’s not hard to avoid these—just don’t guess, pad, or overgeneralize.

How to Stay Out of Trouble

If you want your REPS or STR claim to hold up:

- Track hours as you go

- Log what you did, how long it took, and who did it

- Save receipts, photos, emails, and messages

- Don’t try to backfill it all in April

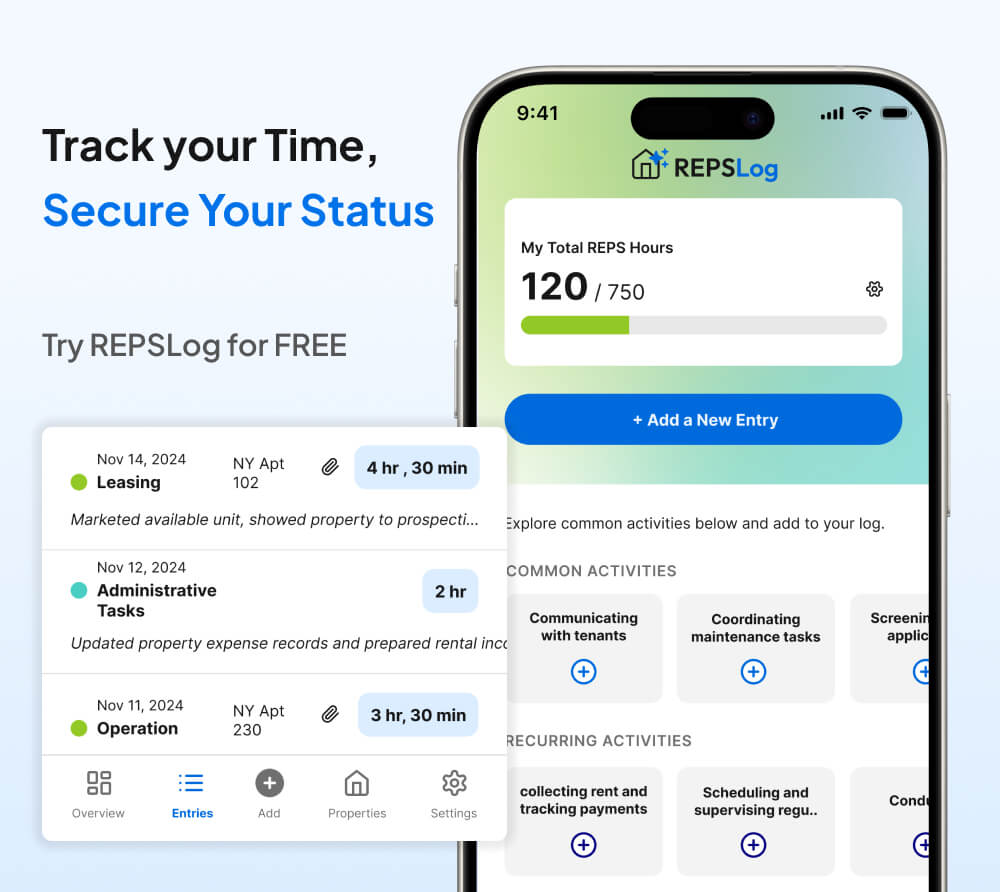

And if you want to make it way easier on yourself, use the REPSLog App. It’s built to do exactly what the IRS is asking for:

- Log entries in real time

- Use AI to auto-fill your activities, dates, and categories

- Attach your proof

- Track hours for you and your spouse

- Log other participants if needed (cleaners, co-hosts, etc.)

- Export a clean, audit-ready report

Final Thoughts

This IRS guide isn’t theory—it’s how audits actually happen.

If you’re using REPS or the STR loophole, make sure you’re tracking the way they expect. The rules are clear. The expectations are written down. And with the right tracking, you can qualify—and defend it.

Want to see what an audit-proof log looks like? Grab our free example and template here.

Please Note: REPSLog is NOT a lawyer or CPA, and this is not legal or financial advice. Please consult a qualified professional for guidance regarding IRS rules and regulations.