If you’re a real estate investor and you’ve never commissioned a cost segregation study, it might be one of the most overlooked tools in your tax strategy.

Whether you’re managing a long-term rental or operating short-term rentals full-time, a cost segregation study helps accelerate depreciation on specific components of your property, increasing your deductions when you actually need them—now, not 27.5 years from now.

This post walks through what a cost seg study looks like, how it’s structured, how much it costs, and what kind of impact you can expect.

What Is a Cost Segregation Study?

A cost segregation study is a formal engineering-based analysis that breaks out your property into individual components, assigning them shorter recovery periods under the IRS’s Modified Accelerated Cost Recovery System (MACRS) (IRC §168).

Residential rental properties are normally depreciated over 27.5 years, while commercial buildings use 39 years. But not everything in your property ages the same way. Things like carpeting, lighting, appliances, and even landscape improvements wear out—and can be depreciated—much faster.

A proper cost segregation study for real estate identifies these components and reclassifies them into 5-, 7-, or 15-year depreciation schedules, based on IRS rules.

The IRS outlines this approach in its Cost Segregation Audit Techniques Guide (ATG), which sets the standard for documentation and classification.

Land vs. Building: Why It Matters

Before any depreciation happens, you’ll need to break out the land vs. building value. Land can’t be depreciated under IRC §167(a), so only the building portion qualifies.

Let’s say you buy a $500,000 property and allocate 80% ($400,000) to the building and 20% ($100,000) to land. The $400K is your starting point for the cost seg study. If your land allocation is higher—say 30% or more—your total depreciable base shrinks, which reduces the benefit of reclassification.

Step-by-Step: How a Cost Segregation Study Works

1. Feasibility Review

Most providers offer a free upfront review. They’ll estimate how much of your cost basis could shift into short-life assets and whether the benefit outweighs the study cost.

2. Document Gathering

You’ll usually need to provide:

- Closing statement or HUD-1

- Purchase allocation or appraisal

- Blueprints or floorplans (if available)

- Renovation invoices

This helps the study comply with IRS documentation standards.

3. Engineering & Cost Allocation

This is where the real work happens. Analysts go through your building and identify components that fall under:

- 5-year property: Appliances, carpet, cabinets, window treatments

- 15-year property: Landscaping, walkways, fencing

- 27.5- or 39-year property: Structural walls, roof, framing

They’ll use industry data (like RSMeans) or your invoices to assign real values.

4. Final Report Delivery

You’ll receive a detailed report that includes:

- Breakdown of each component by useful life

- Depreciation schedules

- Summary tables for your CPA

- IRS-compliant documentation in case of an audit

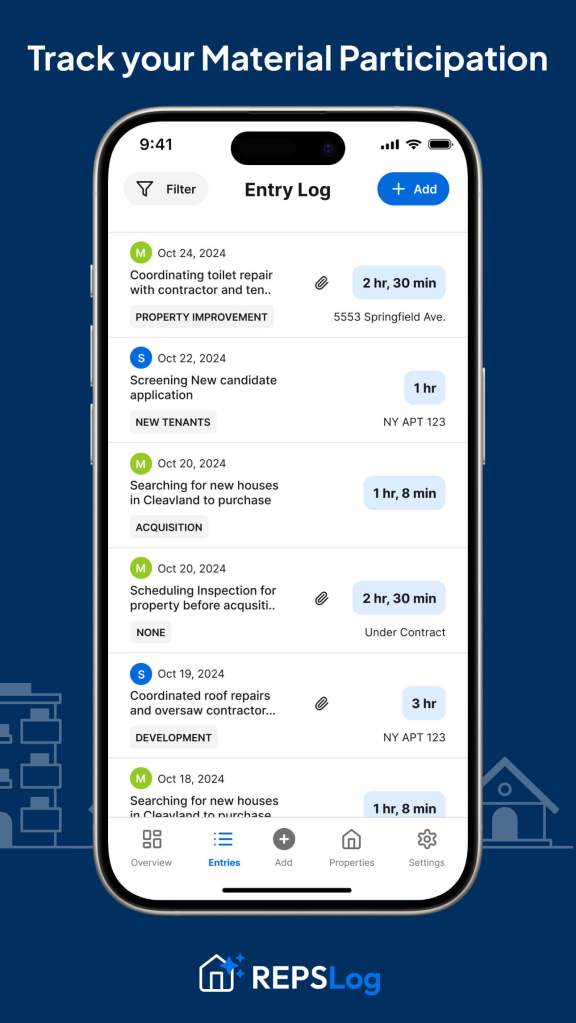

Quick Note on REPS and Tracking Time

Now here’s where it all ties together: A cost segregation study only creates passive losses. To use those losses against active income (like your W-2 or business earnings), you need to qualify as a Real Estate Professional , or leverage the STR Loophole. That means logging hours, materially participating, and keeping solid records.

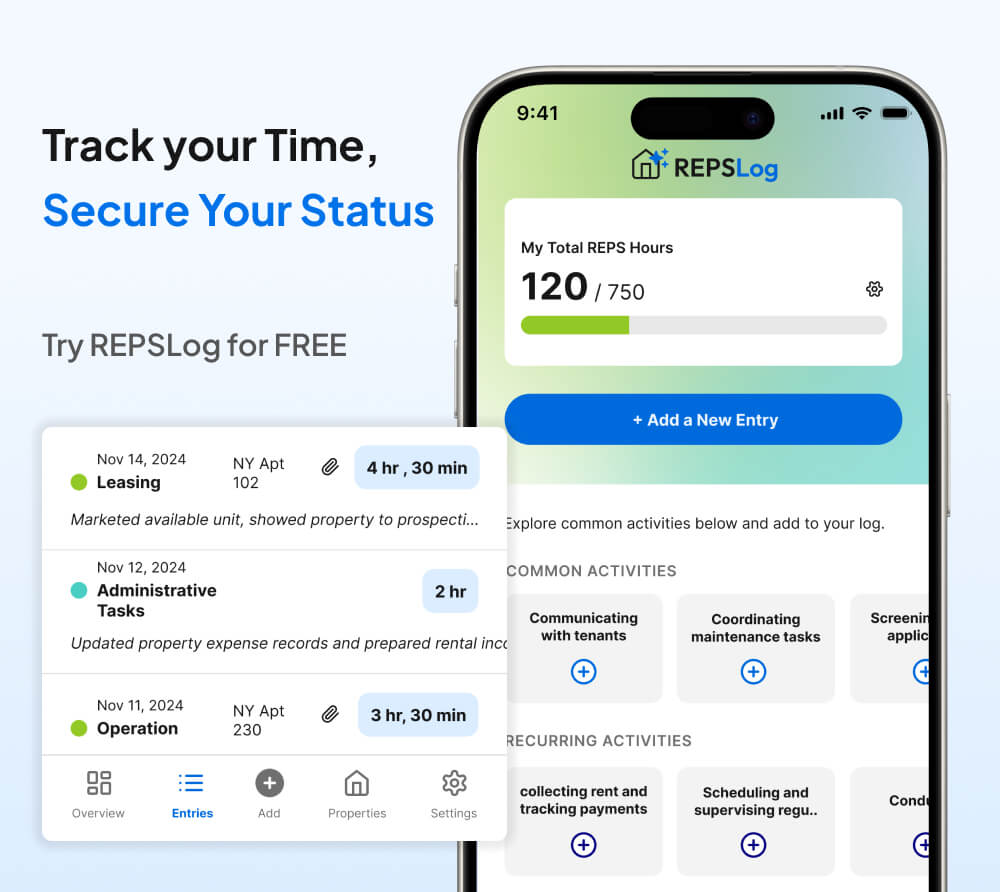

That’s exactly why we created REPSLog. It’s a simple app built to help track hours, assign them by property, and generate audit-ready logs, because most people drop the ball on documentation, not strategy. If you’re doing a cost seg study, make sure you can actually use the losses.

How Much Does a Cost Seg Study Cost?

Here’s what you can expect:

| Property Type | Typical Study Cost |

|---|---|

| Single-Family Rental | $2,000 – $4,000 |

| Small Multifamily | $3,000 – $6,000 |

| Larger Commercial or Portfolio | $5,000 – $15,000+ |

For properties under $1M, some firms offer more affordable modeling studies—just be aware these may carry a slightly higher audit risk if not supported by engineering-level detail.

When a Cost Seg Study Makes Sense

You’ll usually see the most benefit if:

- You spent $250K or more on acquisition or renovations

- The property is held for at least a few years

- You’re using the STR loophole or aiming for REPS

- You want to accelerate depreciation while your income is high

And yes, that $250K figure isn’t law—it’s just the rough point where the math starts to make sense. If your property is too small or your land allocation is high, the savings might not outweigh the cost of the study.

Final Thoughts

A cost segregation study is one of the most effective ways to front-load depreciation and reduce your tax burden as a real estate investor. But don’t forget—it’s only half the equation. If you want to actually apply those deductions to your active income, you need to qualify for REPS/STR Loophole and keep records that hold up.

That’s where the strategy meets the execution. And in my experience, the investors who track their hours well usually win the audit game before it ever starts.

Please Note: REPSLog is NOT a lawyer or CPA, and this is not legal or financial advice. Please consult a qualified professional for guidance regarding IRS rules and regulations.