Let’s face it—qualifying for the Real Estate Professional Status (REPS) or Short-Term Rental (STR) Loophole can feel like jumping through flaming hoops while juggling tax returns. But with a little clarity and the right tools, it’s totally doable—and wildly beneficial.

We’re breaking it down in a Q&A format to keep it simple, straight, and actionable.

Q1: What exactly is REPS (Real Estate Professional Status)?

A: REPS stands for Real Estate Professional Status—a tax designation that allows qualified real estate investors to deduct rental losses against their ordinary income. Normally, rental losses are considered “passive,” which limits how much you can deduct. But if you qualify for REPS, those losses turn “non-passive,” meaning you can offset W-2 income, business income, and more.

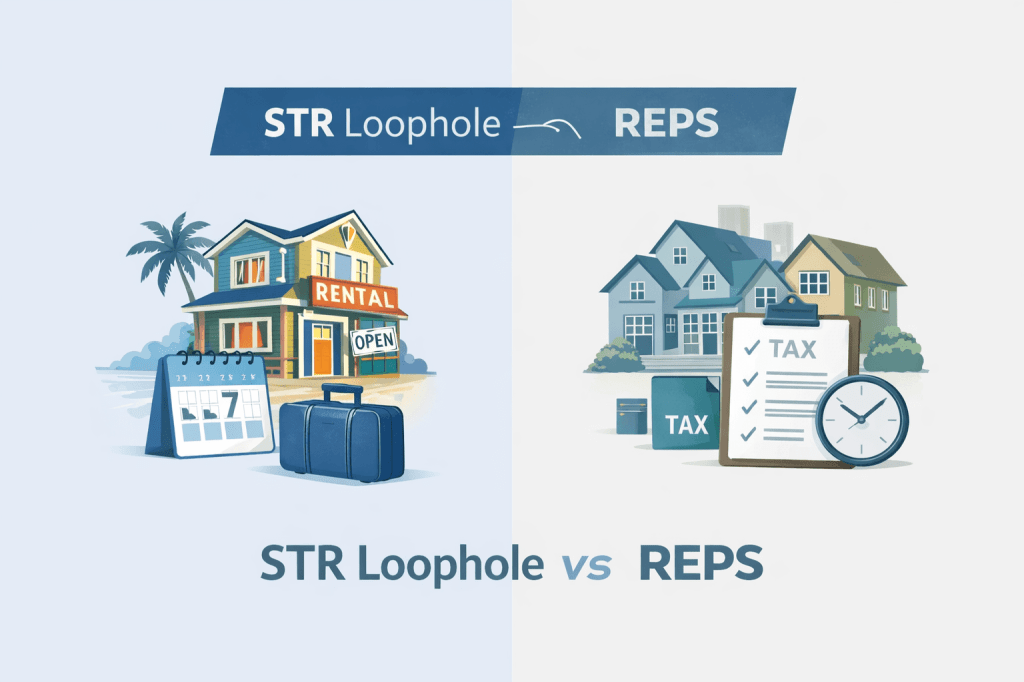

Q2: And The Short-Term Rental (STR) Loophole—what’s that all about?

A: While short-term rentals are technically a subset of rental real estate, it has its own unique tax carve-out. You don’t have to qualify as a real estate professional to deduct losses if you meet certain material participation rules. STRs are great for folks who don’t want to go full REPS but still want juicy tax savings.

Q3: Why is qualifying for REPS or STR so tricky?

A: Because the IRS doesn’t mess around. The bar for REPS is high:

- You need 750+ hours per year spent materially participating in real estate activities.

- It has to be more than half your total working hours.

For the STR loophole, the rules are slightly looser, but you still need to prove material participation, usually hitting one of seven IRS tests—like spending 100 hours and more than anyone else.

And here’s the kicker: You need solid documentation. “I think I did it” won’t fly in an audit.

Q4: How does Hall CPA help investors qualify for these tax strategies?

A: Hall CPA isn’t just any accounting firm. They’re laser-focused on real estate investing, and they’ve helped thousands of clients navigate REPS and STR.

Here’s what they bring to the table:

- Custom strategy sessions to see which path (REPS, STRs, or other strategies) makes sense for your situation.

- Tax planning to optimize deductions and avoid red flags.

- Audit-proof documentation standards.

- Knowledge of court cases and IRS patterns that could make or break your claim.

- Proven experience successful defending both STR and REPS related audits.

If you want a CPA firm that speaks real estate fluently, Hall CPA is your team.

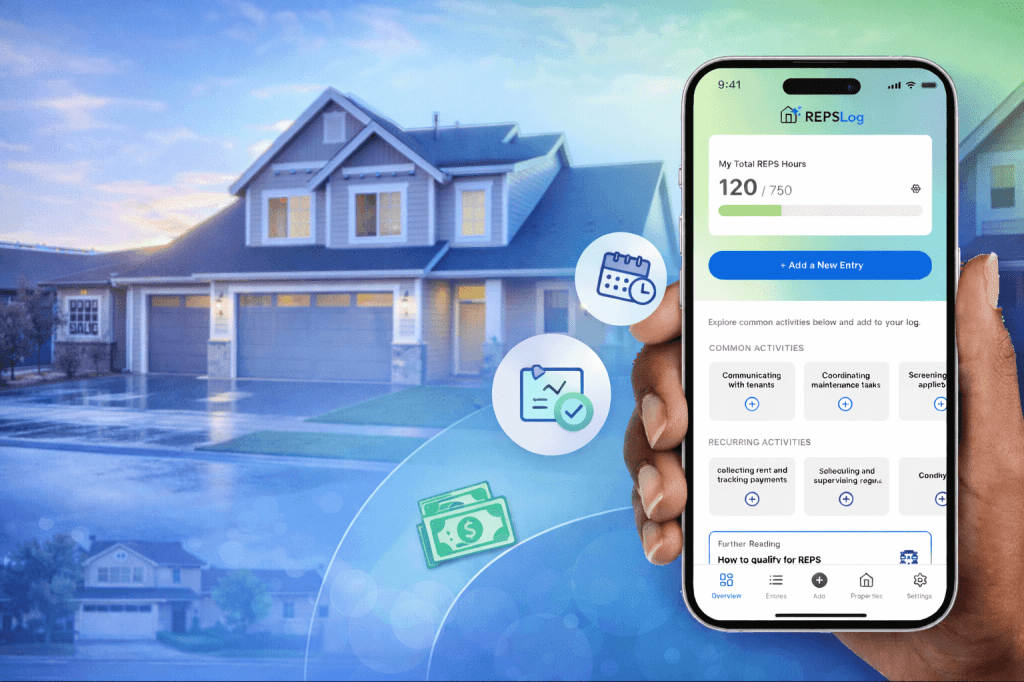

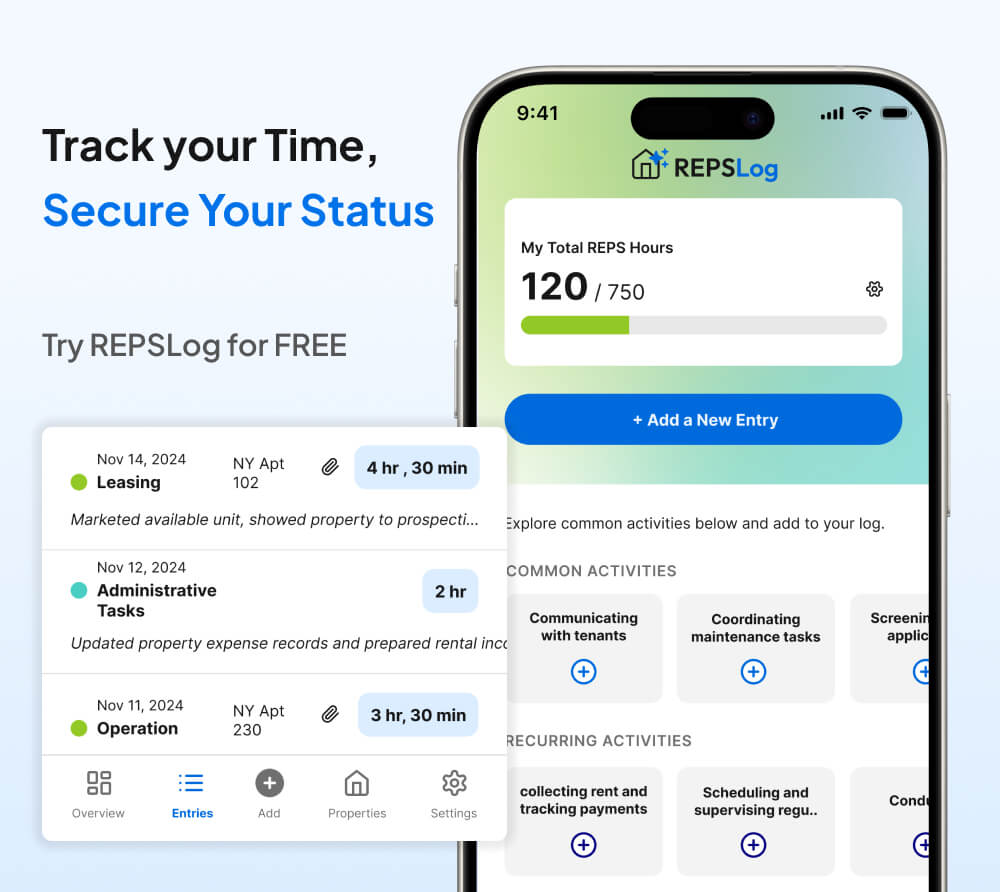

Q5: What is REPSLog, and why do investors use it?

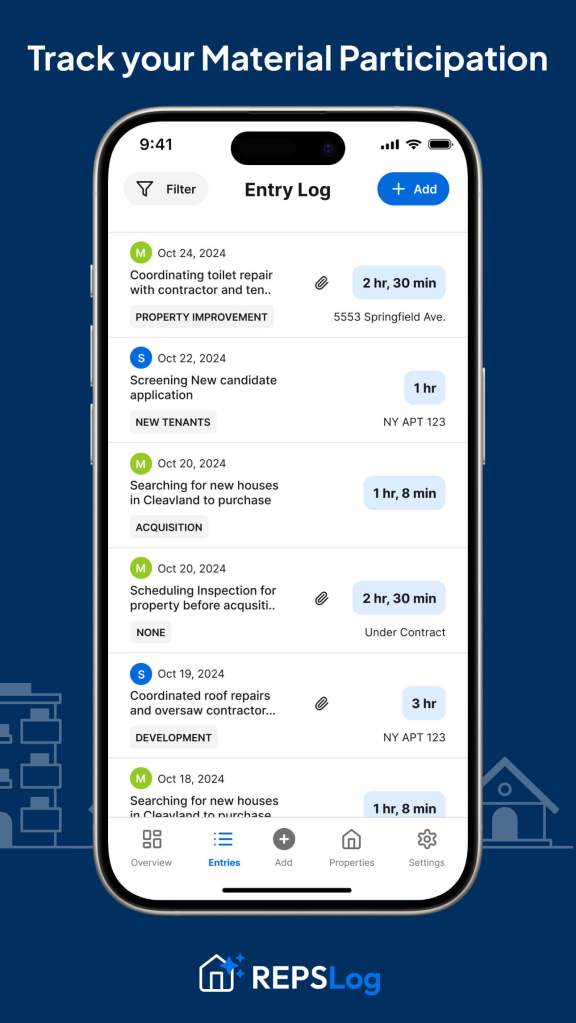

A: REPSLog is a time-tracking tool made specifically for real estate investors trying to qualify for REPS or STR. It helps you log hours in real time, organize activities, and export detailed logs that you can hand to your CPA or keep for IRS documentation.

Why investors love it:

- App-based logging: No more guessing or backtracking. Log 5x times faster with AI assistance

- IRS-aligned categories: Keeps logs in the exact format the IRS wants.

- Exportable reports: Easy hand-off to your tax advisor (like Hall CPA).

- Audit defense ready: Your hour logs are bulletproof, organized, and consistent.

- Log hours from any device: all features are available both on the mobile app and the web version.

Q6: What activities count toward REPS or STR hours?

A: Not all time spent on real estate counts. You’ve got to be involved in direct, hands-on tasks. Here’s what typically counts:

- Managing properties

- Tenant communications

- Booking and scheduling for STRs

- Renovations and maintenance (if self-managed)

- Local Travel Time (in some cases)

But here’s what doesn’t count:

- Education

- Researching markets (if not directly tied to a deal)

- Investor meetings or masterminds

Hall CPA can help classify these activities correctly, and REPSLog lets you label them as you go.

Q7: Can I qualify for REPS or the STR Loophole while working a full-time job?

A: Due to the “more than half your working time” requirement, it’s very challenging, if not impossible, to qualify for REPS with a full-time job, as evidenced through audits and tax court cases.

However, because you don’t need to qualify for REPS and spend more than half your total working time in real estate to use the STR Loophole, qualifying with a full-time job is more practical.

In both cases, using REPSLog to track hours and Hall CPA to guide your strategy can help you cross the finish line confidently.

Q8: What are the biggest mistakes investors make trying to qualify?

- Backfilling logs at year-end (major audit risk).

- Not tracking hours at all.

- Counting non-qualifying activities as material participation.

- Assuming STRs are passive—and missing out on deductions.

- Failing to work with a real estate-savvy CPA.

Hall CPA sees these mistakes all the time—and helps you avoid them from day one.

Q9: How do Hall CPA and REPSLog work together?

A: They complement each other beautifully. Hall CPA can guide you on how to properly use these strategies for your situation, avoiding critical mistakes that can cost you in an audit. You then use REPSLog to track hours, handing over the clean, categorized logs to Hall CPA. Hall CPA uses that data to:

- Validate REPS or STR eligibility.

- Prepare your taxes accordingly.

- Back you up if the IRS ever comes knocking.

Think of REPSLog as your daily defense and Hall CPA as your strategic tax coach.

Q10: How much does this combo actually save investors?

A: Depending on your income level and real estate losses, qualifying for REPS or STR Loophole could wipe out tens to hundreds of thousands in taxes per year.

We’re talking:

- $20K+ tax savings for mid-level investors

- $100K+ for high-income professionals with big depreciation losses

- Massive acceleration in portfolio growth due to reinvested tax savings

All for the cost of a smart tool and a tax team that gets it.

Q11: How many properties do I need to own to claim REPS or the STR Loophole?

While some tax court cases have supported qualifying for REPS with just one property, it typically requires multiple rentals to meet the 750-hour requirement—especially if rentals are your only real estate activity.

As for STRs, the material participation tests are significantly easier to meet, and many investors qualify for the STR loophole with just a single property.

Q12: Can I combine hours with my spouse?

For REPS, one spouse must independently meet the 750-hour requirement and more than half of their total working time tests. Hours cannot be combined.

However, hours can be combined for the material participation hours for STRs.

Quick Recap: Why You Should Use Hall CPA + REPSLog

✅ REPSLog gives you:

- Real-time, audit-proof hour tracking

- Categorized activity logging

- Easy exports for tax filing

✅ Hall CPA brings:

- Real estate-specific tax expertise, strategy, and planning.

- Accurate and compliant tax preparation and filing.

- Audit defense and compliance

Together, they turn what’s normally a documentation nightmare into a streamlined, confident tax-saving machine.

FAQs

Q: Is REPS only for full-time investors?

A: No, but you do need to spend more time on real estate than any other job. Full-time W-2 workers will have a harder time qualifying.

Q: Can I use REPSLog on mobile?

A: Yep, it’s app-based and designed to log activities on the go.

Q: Is this legal?

A: 100%. These are IRS-approved strategies—as long as you document correctly and follow the rules. That’s where Hall CPA and REPSLog shine.

Q: What happens in an audit?

A: With detailed logs from REPSLog and a defense-ready CPA like Hall, you’re well-equipped to survive and thrive.

Final Thoughts

There’s no denying the power of REPS and STR tax strategies—but they’re not something you want to wing. With REPSLog keeping your hours airtight and Hall CPA keeping your strategy compliant, you’ll have the confidence to claim your deductions and grow your portfolio faster.

If you’re serious about saving on taxes through real estate, this combo is a no-brainer.

Want to get started?

- Check out REPSLog to start logging hours today.

- Schedule a consultation with Hall CPA to see how you can qualify this year.

About The Author

Thomas Castelli, CPA, CFP® is a Partner at Hall CPA and real estate investor who helps other real estate investors keep more of their hard-earned dollars in their pockets and out of the government’s. Hall CPA has helped hundreds of investors successfully use strategies such as the real estate professional status (REPS), short-term rentals (STRs), and many others to reduce taxes while remaining compliant with the IRS significantly.Want to lower your taxes with REPS, STRs, and other strategies while remaining compliant with the IRS? Book a free 30-minute discovery call with Hall CPA by clicking here to see how they can help.