If you’ve ever looked at your tax bill and wondered, “Are real estate taxes the same as property taxes?”—you’re not alone. It’s one of those phrases that gets tossed around in conversations with accountants, lenders, and county officials, often interchangeably.

But are they actually the same thing? And more importantly, does it affect how you deduct expenses or track participation for tax purposes?

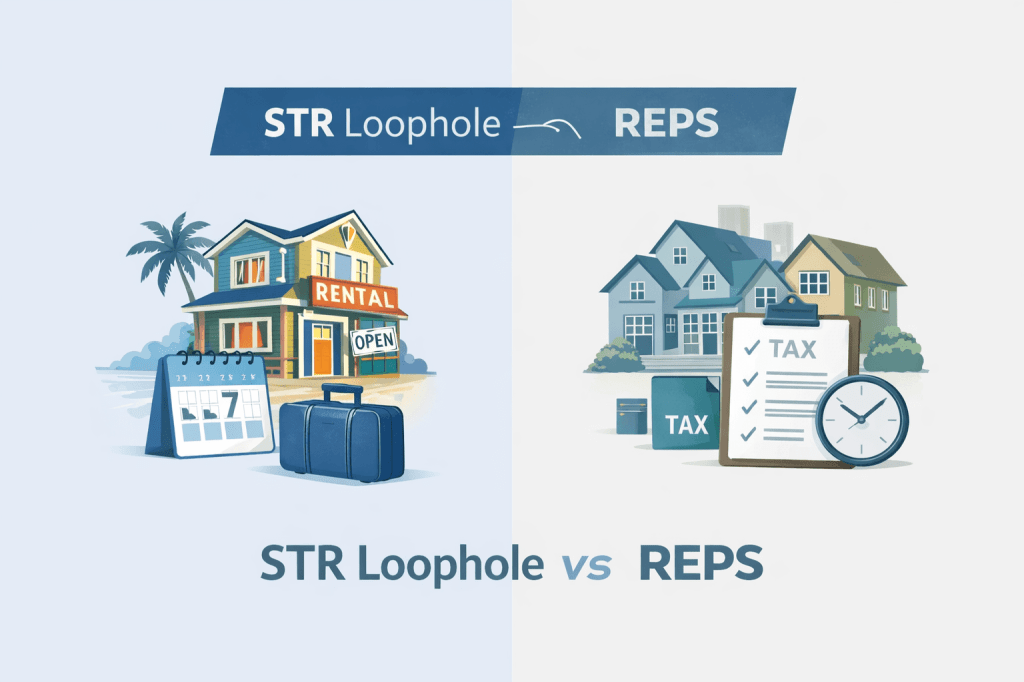

Let’s break it down clearly—especially for real estate investors trying to stay compliant, reduce taxes, and get the most out of IRS rules like the Real Estate Professional Status (REPS) and the short-term rental tax loophole.

Is Real Estate Tax the Same as Property Tax?

In almost every case: yes.

“Real estate tax” and “property tax” are typically used interchangeably to describe a local or state tax assessed on real property, which includes land and any permanent buildings or improvements attached to it. These taxes are usually paid annually and are based on the assessed value of the property.

You might see “real estate tax” in IRS forms or mortgage paperwork, while your county assessor or city government might refer to it as “property tax.” Either way, they’re talking about the same thing.

So when you ask, “Is property tax and real estate tax the same?”—you’re really asking a language question, not a legal one. In the eyes of the IRS and local governments, they’re generally treated the same way.

Real Estate Tax vs. Property Tax: A Closer Look

Even though the terms are used interchangeably, it helps to understand how they fit into the broader tax landscape—especially if you’re a real estate investor.

| Term | Common Use | Applies To |

|---|---|---|

| Property Tax | Most commonly used by counties and local governments | Real property (land + structures) |

| Real Estate Tax | Used by lenders, title companies, and the IRS | Same as above |

| Personal Property Tax | Different category entirely | Movable items like vehicles, boats, business equipment |

The only real distinction to be aware of is personal property tax, which can sometimes confuse newer investors. That tax applies to tangible items you own—not land or buildings. So while your rental duplex is subject to real estate tax, your truck or laptop may be subject to personal property tax if used for business purposes in some states.

How These Taxes Affect Real Estate Investors

Whether you call it a real estate tax or property tax, one thing is clear: it’s a deductible expense if the property is used for rental or investment purposes.

If you file a Schedule E for rental income, you’ll typically include your property taxes in the “Taxes” line item. These taxes reduce your net rental income, which lowers your overall taxable income.

Here’s where it gets more strategic:

If you’re working to qualify for Real Estate Professional Status or trying to leverage the short-term rental tax loophole, understanding and organizing these expenses is only half the battle. The other half is proving that you materially participated in the rental activity.

Why Time Tracking Matters More Than Tax Labels

Whether you pay high property taxes or low ones, the IRS doesn’t really care what the line item is called. What they care about—especially when it comes to REPS—is how involved you were in managing the property.

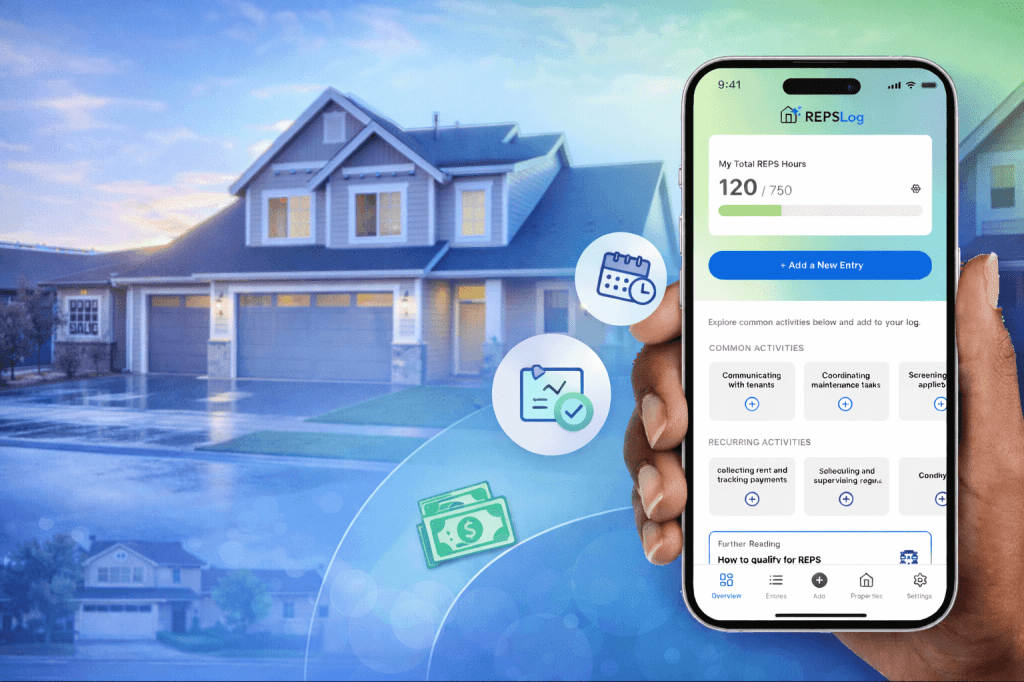

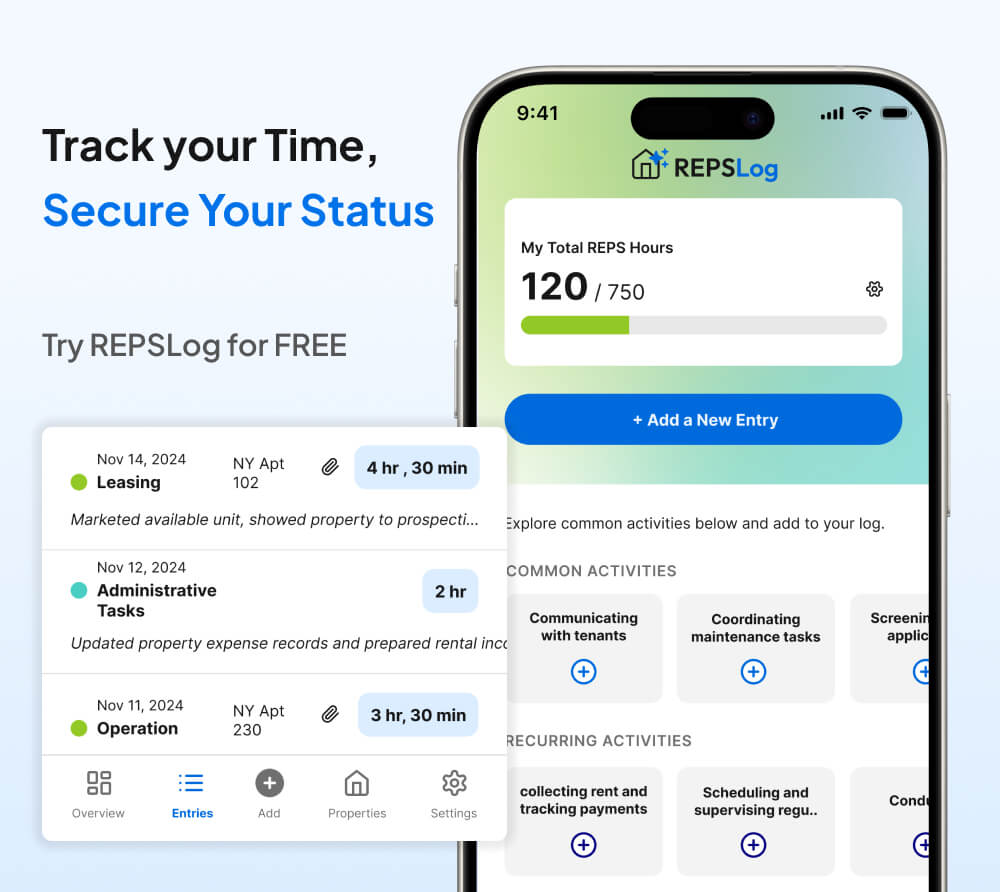

That’s where REPSLog comes in.

Why We Track Hours with REPSLog

If you’re pursuing Real Estate Professional Status or using the short-term rental tax loophole, keeping detailed time logs is critical. The IRS requires you to prove material participation, not just list deductions.

That’s where REPSLog comes in. We designed it to help real estate investors track and categorize their work hours—by property, activity type, and date—so you’re ready to demonstrate your involvement at tax time. It doesn’t track bills or payments, but it does make sure your time is documented clearly, consistently, and in an IRS-friendly format.

It’s easy to forget how much time you spend handling tenant issues, reviewing statements, coordinating repairs, or updating listings. But when it comes to IRS audits or proving REPS status, those hours matter. REPSLog gives you a simple way to stay compliant and prepared.

Example: Why the Distinction Doesn’t Change Your Strategy

Let’s say you own a short-term rental in Florida, and you paid $5,000 in property taxes last year. You listed it on your Schedule E. Great—but what if you also spent over 150 hours actively managing it?

If you pass the material participation tests, you could potentially claim losses against your ordinary income, thanks to the short-term rental tax loophole. That deduction has nothing to do with whether the $5,000 was called a “real estate tax” or a “property tax.”

The takeaway? Deductions matter, but participation matters more.

FAQs About Real Estate Tax vs. Property Tax

Is real estate tax the same as property tax?

Yes. In nearly all contexts, real estate tax and property tax refer to the same thing: a local tax based on the assessed value of your land and buildings.

Are personal property taxes the same as real estate taxes?

No. Personal property taxes apply to movable assets like vehicles or business equipment. Real estate taxes apply to land and permanent structures.

Can real estate taxes be deducted on my taxes?

Yes. For rental properties, real estate (or property) taxes are typically deductible on Schedule E as an expense.

Why does it matter if I track my hours?

The IRS requires proof of material participation if you want to deduct passive losses or qualify as a real estate professional. Logging your hours with REPSLog gives you a defensible record in case of an audit.

How often should I log my hours?

Ideally, weekly or as you complete tasks. The more consistent your logs, the stronger your case during a potential IRS review.

Final Thoughts

So, are real estate taxes the same as property taxes?

Yes—for practical, financial, and IRS purposes, they are. But the real value for investors isn’t in what these taxes are called—it’s in how you document your time managing those properties.

If you’re working toward REPS or leveraging the STR loophole, don’t let the details slip through the cracks. Tracking your participation hours is one of the most important things you can do to protect your tax position and reduce your liability.

Please Note: REPSLog is NOT a lawyer or CPA, and this is not legal or financial advice. Please consult a qualified professional for guidance regarding IRS rules and regulations.