If you’ve been following real estate tax strategy over the past few years, you already know how valuable bonus depreciation can be—especially when paired with cost segregation or the short-term rental tax loophole.

But in 2025, the rules are changing again. Or maybe not.

There’s growing momentum in Congress to bring back 100% bonus depreciation, and while nothing is finalized yet, investors are watching closely. Here’s what you need to know about where things stand right now—and how to prepare either way.

Quick Recap: What Is Bonus Depreciation?

Bonus depreciation allows you to deduct a large portion of an asset’s cost in the year it’s placed in service—rather than spreading that deduction over several years.

From 2018 to 2022, the Tax Cuts and Jobs Act (TCJA) made that deduction 100% for qualifying assets. That meant real estate investors who used cost segregation studies could write off major portions of a property’s value in the first year.

But TCJA also included a phase-out schedule:

| Year | Bonus Depreciation Rate |

|---|---|

| 2022 | 100% |

| 2023 | 80% |

| 2024 | 60% |

| 2025 | 40% (unless changed) |

| 2026 | 20% |

| 2027 | 0% |

What’s Happening to Bonus Depreciation in 2025?

Right now, bonus depreciation is technically at 60% for 2025. But key lawmakers from both parties have been pushing to reinstate 100% bonus depreciation retroactively, as part of a broader tax extender package.

In early 2024, the U.S. House of Representatives passed the Tax Relief for American Families and Workers Act of 2024, which included a provision to restore 100% bonus depreciation through 2025.

However, the bill stalled in the Senate. As of mid-2025:

- Negotiations are still ongoing

- Bipartisan support for 100% bonus depreciation remains strong

- Retroactive reinstatement is still possible

This means there’s still a real chance that 100% bonus depreciation could return for 2025, especially if tied to larger tax legislation during year-end negotiations or election-year incentives.

What Should Real Estate Investors Do Right Now?

Until new legislation is finalized, it’s smart to plan both ways:

- If 100% bonus depreciation is restored:

- Properties placed in service in 2025 could qualify retroactively for full write-offs

- Cost segregation studies would unlock bigger upfront deductions

- You’ll want your hours logged and documented to use those losses against ordinary income

- If it stays at 60%:

- You can still take partial bonus depreciation in year one

- The rest of the deduction is spread over 5, 7, or 15 years

- The REPS or STR loophole is still valuable, but timing becomes more important

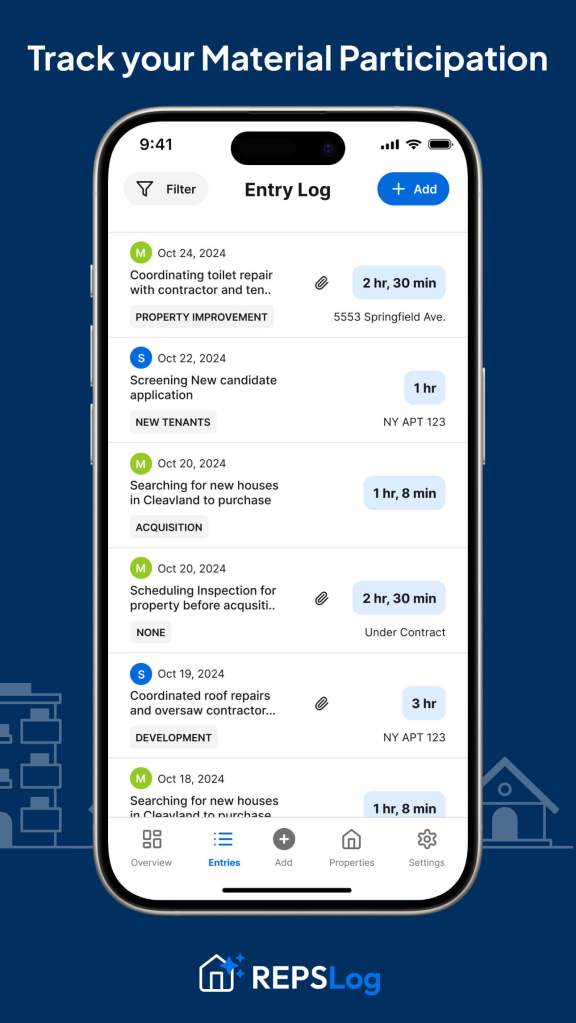

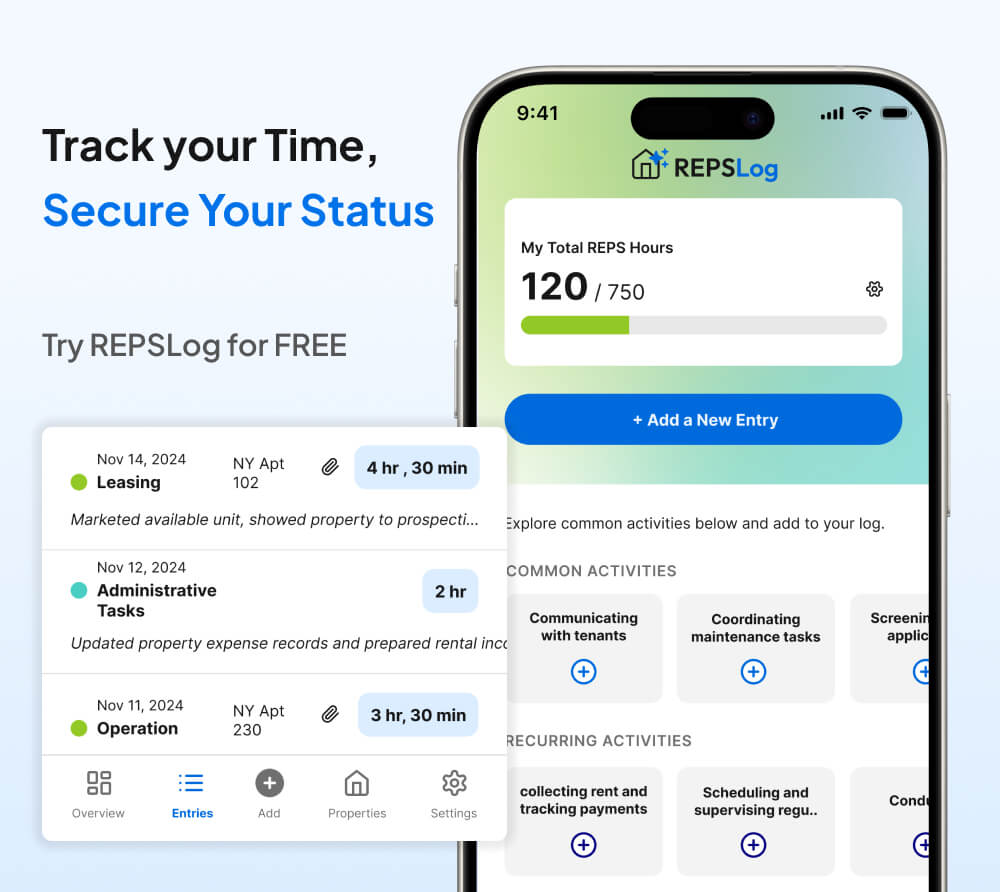

In both cases, proving material participation is critical. That’s where tools like REPSLog come in.

Why We Built REPSLog

The biggest mistake we see investors make isn’t missing bonus depreciation opportunities—it’s not being able to prove that they actively participated in their rental business.

If your losses are considered passive, even the best depreciation strategy won’t reduce your W-2 or business income.

REPSLog helps real estate investors:

- Track time by property and task

- Stay compliant with IRS tests

- Build a defensible record for REPS or STR audits

We don’t track depreciation numbers—that’s your CPA’s job. But if you’re planning to claim those deductions as non-passive, we help make sure your time logs support your tax position.

FAQs About Bonus Depreciation in 2025

Is bonus depreciation 100% in 2025?

Not yet. As of mid-2025, the rate is 60%. However, a bill to retroactively reinstate 100% bonus depreciation is still under consideration in Congress.

Can I wait to place a property in service?

Some investors are waiting to place assets in service later in the year in hopes that 100% is reinstated. But talk to your CPA first—timing matters.

Will the 100% rule apply retroactively if passed?

That’s the current proposal. If the tax extender bill passes, it would likely apply to all of 2025.

What qualifies for bonus depreciation?

Appliances, HVAC, certain improvements, and components identified in cost segregation studies (5, 7, 15-year property).

How do I make those losses count against active income?

You need to prove material participation. For that, log your hours—consistently and in detail—with REPSLog.

Final Thoughts

Bonus depreciation remains one of the most powerful tools in a real estate investor’s tax toolbox. And while 2025 has brought uncertainty, there’s still hope for a return to 100%—possibly retroactively.

Whether Congress acts or not, the best strategy is to stay proactive. Do the cost seg. Track your hours. And make sure you’re ready to take full advantage if the opportunity returns.

Please Note: REPSLog is NOT a lawyer or CPA, and this is not legal or financial advice. Please consult a qualified professional for guidance regarding IRS rules and regulations.