Let’s be honest—most “top 10 real estate investing books” lists just recycle the same old titles. Rich Dad Poor Dad (again?). The Millionaire Real Estate Investor (still good, but come on). If you’re here, you’re probably doing more than just dreaming—you’re already in the game, or you’re about to be. You want books that move the needle.

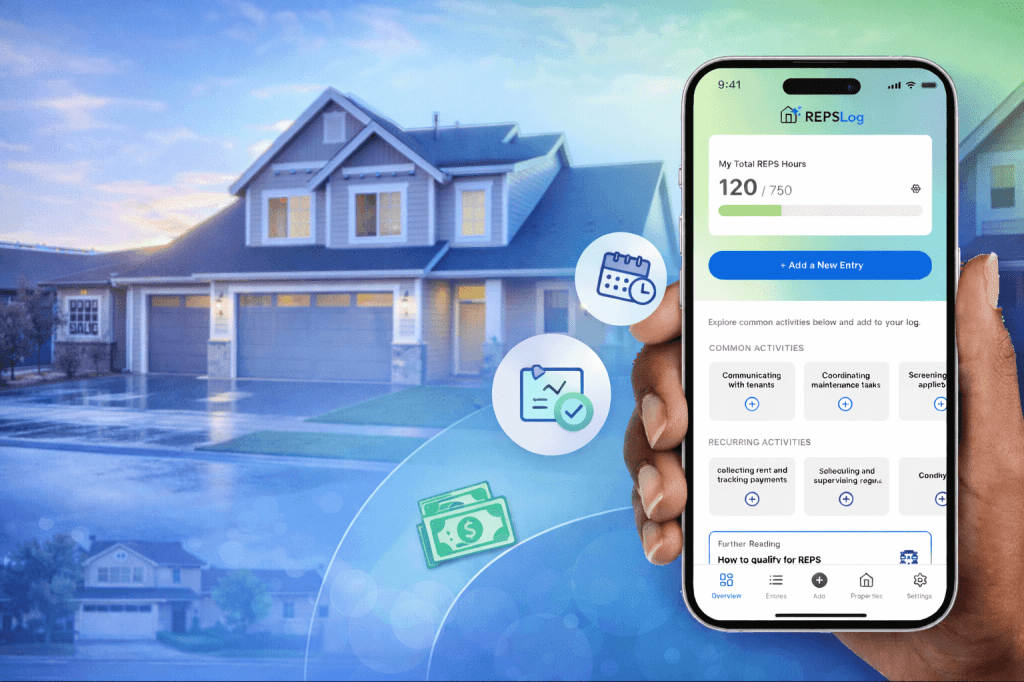

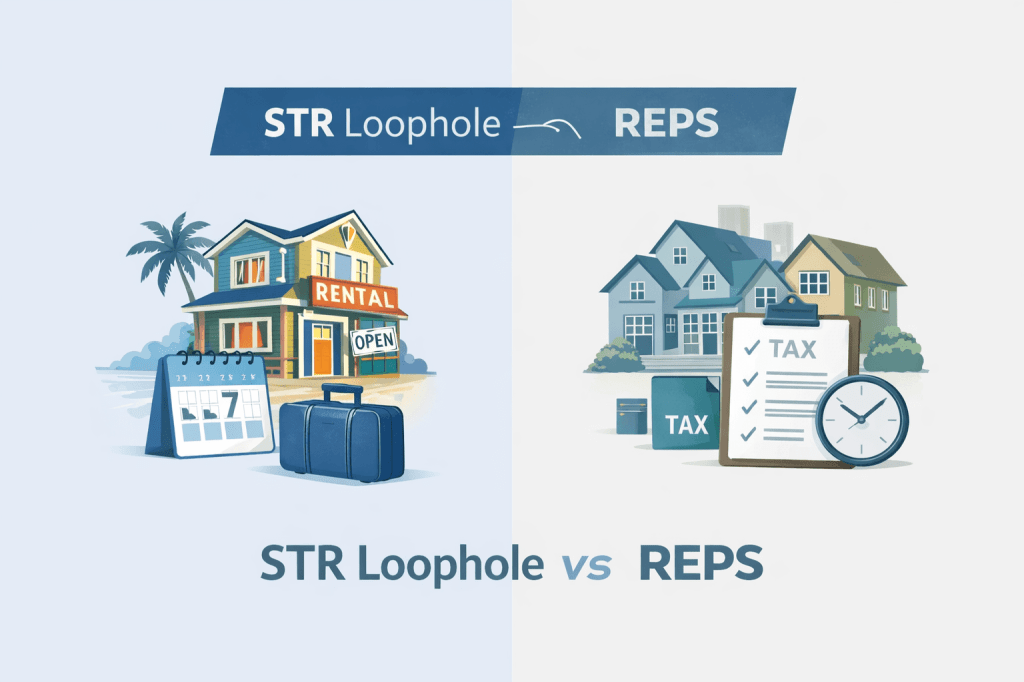

Especially if you’re trying to qualify for Real Estate Professional Status (REPS), take advantage of the Short-Term Rental (STR) loophole, or stack depreciation like a pro, you need more than just motivation. You need real, tactical guidance.

So here it is—our curated list of the best books on real estate investing that are actually useful for today’s tax-savvy investor.

1. Tax-Free Wealth by Tom Wheelwright

Best for: Learning how the IRS wants you to use real estate to reduce taxes

This is the real tax bible for real estate investors. Wheelwright (CPA and advisor to Robert Kiyosaki) teaches how to legally reduce taxes through depreciation, cost segregation, and smart structuring. He’s pro-REPS and STR without even saying the buzzwords.

🔥 “The tax law is a series of incentives.” Once you get that, the whole game changes.

2. Short-Term Rental, Long-Term Wealth by Avery Carl

Best for: STR investors who want financial freedom and tax benefits

Avery Carl built her empire by buying STRs in cash-flow markets—not tourist traps. Her book covers location selection, automation, financing, and how to be hands-on enough to meet the IRS’s material participation tests (yep, that’s your STR loophole).

⚡ STRs + material participation = REPS-like tax savings without 750 hours.

3. The Book on Tax Strategies for the Savvy Real Estate Investor by Amanda Han & Matthew MacFarland

Best for: Day-to-day tax strategies, from write-offs to REPS

Written by two investor-friendly CPAs, this book is packed with real-life tax tactics. If you’ve ever wondered what counts toward your REPS hours—or what to do when you co-own a property with a spouse—this book gets into it. No fluff, just examples and checklists.

✅ Required reading for anyone using REPSLog to track hours.

4. Real Estate by the Numbers by J Scott & Dave Meyer

Best for: Investors who want to analyze deals—not guess

This one’s for spreadsheet lovers and those who should become spreadsheet lovers. It helps you make decisions based on ROI, cash-on-cash returns, and how tax savings like depreciation actually affect your bottom line.

📊 Learn to model the effect of REPS and bonus depreciation on your total ROI.

5. The Millionaire Real Estate Investor by Gary Keller

Best for: A mindset reset—and long-term wealth building

Yes, it’s on every list, but for good reason. This one interviews 100+ millionaire investors and breaks down what actually made them successful. While light on tax strategy, it’s great for shifting from “I own a rental” to “I’m building a portfolio.”

🧠 Strategy-first thinking makes the REPS path easier to commit to.

6. The Book on Managing Rental Properties by Brandon and Heather Turner

Best for: Self-managing and documenting hours for REPS

The Turners walk you through the ins and outs of managing your rentals yourself—perfect if you’re clocking hours toward REPS or STR material participation. Scripts, systems, and sanity-saving advice included.

⏱️ Every maintenance call, tenant screening, and lease signing = logged hour.

7. Buy, Rehab, Rent, Refinance, Repeat (BRRRR) by David Greene

Best for: Active investors scaling quickly

This tactical book shows how to recycle your money through value-add deals. It’s hands-on—perfect for people trying to meet REPS thresholds through real work. Managing contractors, doing walkthroughs, tracking every hour? You’re covered.

🛠️ BRRRR + REPS = powerful combo for aggressive tax savings.

8. Every Landlord’s Tax Deduction Guide by Stephen Fishman

Best for: Deductions, depreciation, and documentation

This book gets deep into write-offs: travel, repairs, mileage, even your home office. And it’s written in plain English. If you want to make sure you’re not leaving money on the table—or need to prove your REPS participation—this is a must.

💡 Also includes forms and IRS guidance you can actually use.

9. The Hands-Off Investor by Brian Burke

Best for: Passive investors and future syndicators

If you’re building toward partnerships, syndications, or just want to understand passive investing better—this one’s a gem. And knowing what qualifies as passive (vs material) activity is key to not disqualifying your REPS status.

⚠️ Passive investing ≠ REPS hours. Know the line before you cross it.

🏠 10. Recession‑Proof Real Estate Investing by J Scott

Best for: Understanding market cycles and protecting/leveraging your portfolio

This one fills the gap for “big picture” investors. J Scott (who’s flipped 400+ homes and holds over $150M in real estate) guides you through how to navigate downturns, allocate capital in both good and bad markets, and stay hands-on or hands‑off as needed.

🛡️ “This book is a roadmap… data lovers will also take value from the charts and graphs” — reviewer

Final Thoughts

You can read your way to smarter investing—or you can do both: read and start tracking. Every hour counts when it comes to qualifying for REPS or maximizing STR tax savings. These books are here to help you do both.

Start with one. Highlight the good stuff. Then go take action.

And don’t forget—reading doesn’t count toward REPS hours… but self-managing your Airbnb definitely does 😉