Securing REP qualification (Real Estate Professional qualification) is one of the most valuable tax strategies available to real estate investors. Achieving REP status unlocks the ability to treat rental real estate activities as non-passive and potentially offset active income — a tax advantage that can save tens or even hundreds of thousands of dollars.

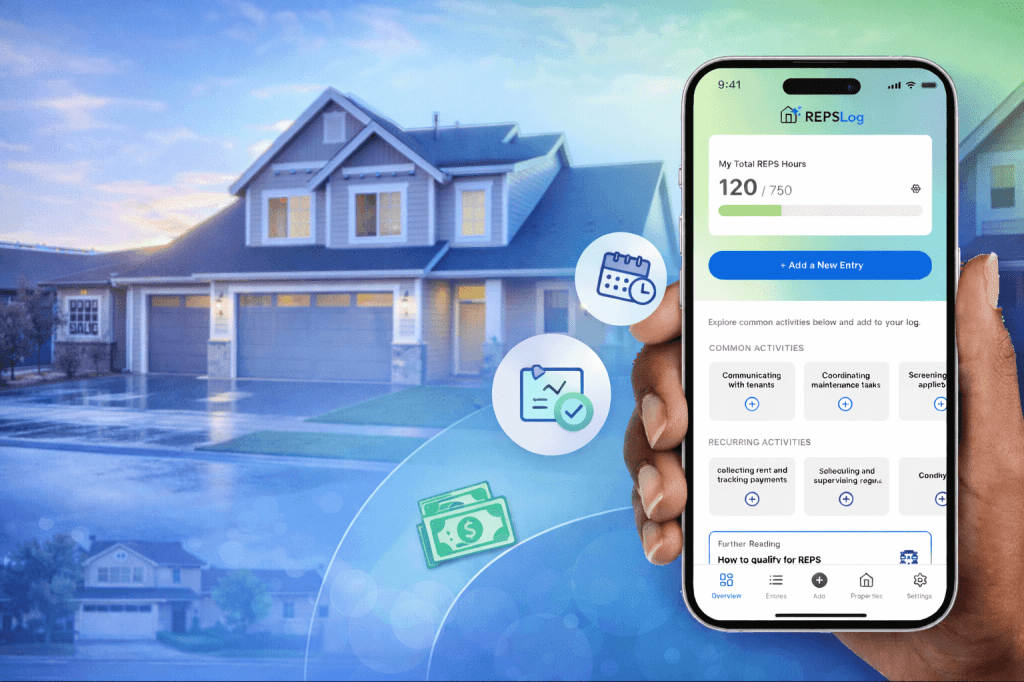

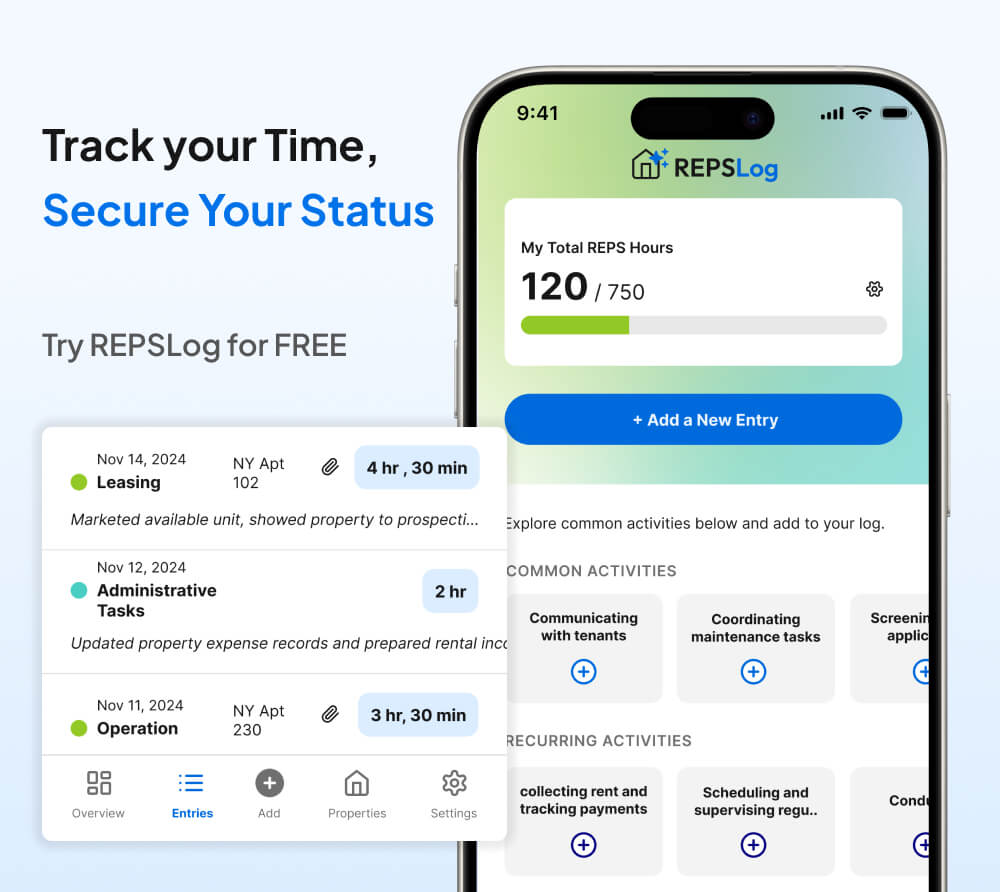

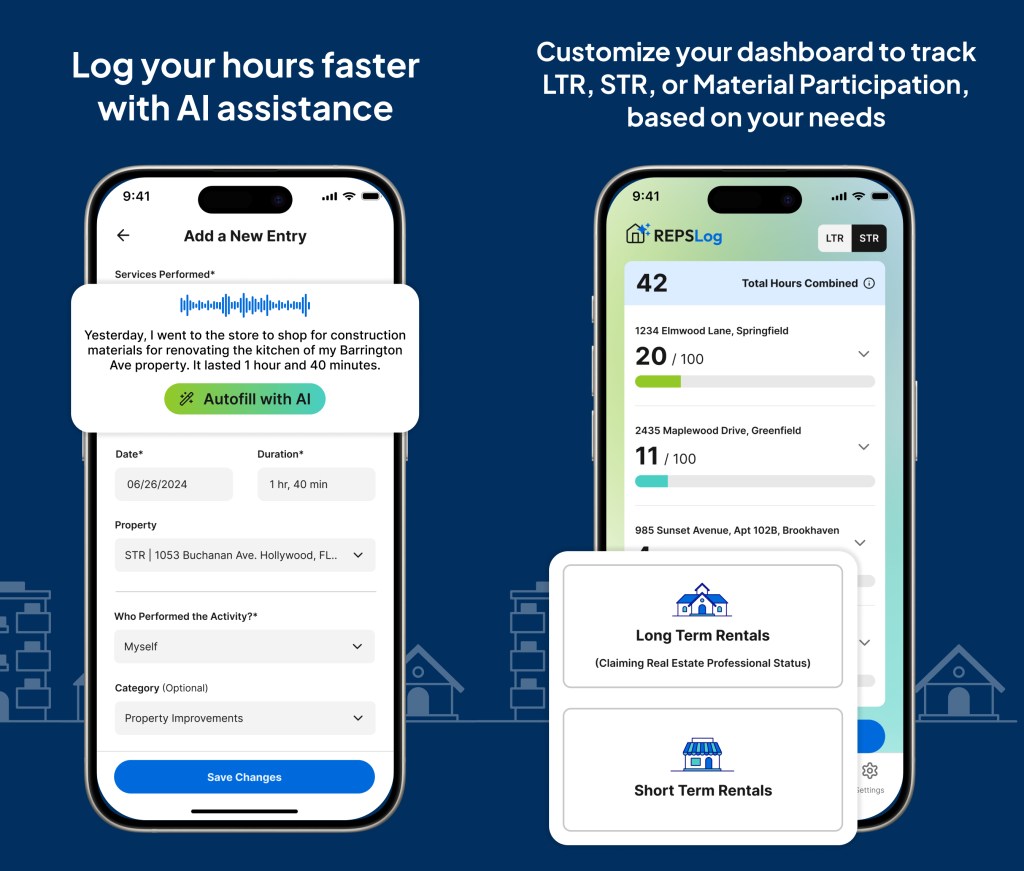

The key, however, is tracking your time accurately — and doing it consistently. That’s where REPSLog makes a real difference. With both a mobile app and a new desktop version, REPSLog lets you log your real-estate activities from anywhere, making it easier than ever to qualify for REP status and keep your records IRS-ready.

You can now manage your REP logs on your laptop while reviewing deals, or on your phone during property visits — everything syncs automatically.

Let’s break down what it takes to achieve and maintain your REP qualification, and how REPSLog helps you every step of the way.

What Is REP Qualification?

To qualify as a Real Estate Professional, the IRS requires that:

- More than 50% of your working hours are spent in real estate, and

- You work 750+ hours per year in real-estate-related activities

And just meeting those tests isn’t enough — you must be able to prove them.

That means logging your time, describing your activities, and keeping records that support your participation.

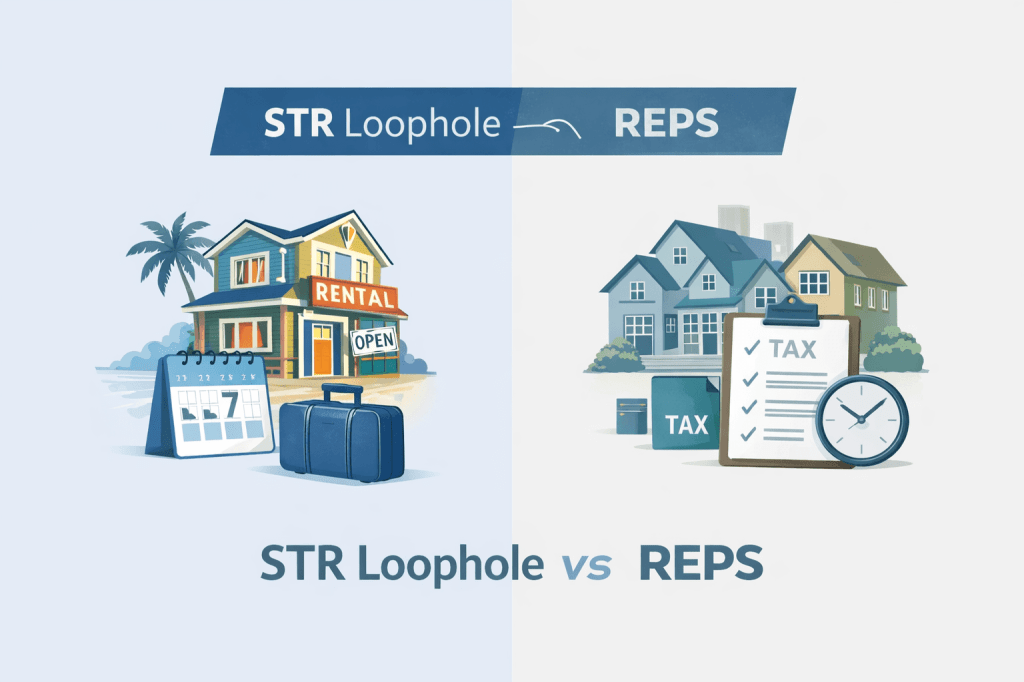

REP Status vs. STR Loophole

Many investors hear about REP status and the Short-Term Rental (STR) loophole and wonder which applies to them — or whether they need both. While both strategies can unlock non-passive treatment, they work differently:

| REP Status | STR Loophole |

|---|---|

| Applies to long-term rentals | Applies to short-term rentals (avg stay < 7 days OR < 30 days w/ services) |

| Requires 750+ hours + >50% test | Requires 100+ hours of material participation (or meeting one of the IRS tests) |

| Annual hours + documented participation required | Hours tracked per property matter — no grouping |

| Often used by active real-estate investors | Popular with W-2 employees & high-income earners |

Both require material participation and both need solid documentation. REPSLog lets you track REP hours and STR hours separately, so you can pursue whichever strategy fits your tax situation — or both.

What Counts Toward Material Participation?

Whether you’re pursuing REP status or using the STR loophole, you must demonstrate material participation. That means being actively involved — not passive.

Activities that count toward material participation include:

| Activity | Counts? | Notes |

|---|---|---|

| Deal analysis & property acquisition work | ✅ | Research, calls, underwriting |

| Tenant communication & screening | ✅ | Messages, calls, lease discussions |

| Managing repairs, maintenance, vendors | ✅ | Scheduling, overseeing work |

| Property showings & walkthroughs | ✅ | On-site visits |

| Travel to and from properties | ✅ | Must be real-estate-related |

| Bookkeeping & financial review | ✅ | Tracking income/expenses, planning |

Meanwhile, purely passive investing tasks — like simply reviewing a monthly statement — do not count.

The IRS cares about day-to-day involvement, and REPSLog gives you a structured way to log each activity — so your hours aren’t just recorded, they’re justifiable.

Why Time-Tracking Protects Your REP Status

IRS audits have proven one thing:

If you can’t prove your hours, you can lose your REP status — even if you really did the work.

Quick estimates, vague notes, and back-filled spreadsheets don’t hold up well. The IRS expects:

| Requirement | Meaning |

|---|---|

| Contemporaneous logs | Track as you go — not months later |

| Specific descriptions | Not “worked on real estate,” but what you did |

| Dates & time durations | Clear hours, not guesses |

| Credible patterns | Regular work, not year-end bulk entries |

| Supporting context | Emails, appointments, drive time, tasks |

Good record-keeping isn’t optional — it’s part of the strategy.

Track REP Hours & STR Hours — Anywhere You Work

Real estate happens on the move — at properties, behind a laptop, in your car, on job sites, and at late-night deal-review sessions.

That’s why REPSLog works everywhere you do:

🖥️ REPSLog on Desktop

- Best for reviewing logs, planning, and entering detailed notes

- Convenient for office time, deal analysis, contractor coordination

- Perfect for organizing annual records before tax prep

📱 REPSLog on Mobile

- Log time on-site, between showings, or during calls

- Capture photos + notes instantly for audit-ready context

- Great for contractors, walkthroughs, tenant conversations

Track both REP status hours and STR loophole hours seamlessly — with automatic syncing between devices.

No spreadsheets. No notebooks. No forgotten hours.

Just a clean, accurate, IRS-friendly system that protects your qualification and your tax savings.

Final Takeaway

Achieving REP qualification and successfully maintaining REP status comes down to two things:

✅ Doing the work

✅ Proving the work

With REPSLog, real-estate investors have the flexibility to log hours in real time, across both desktop and mobile, for both REP status and the STR loophole.

Start logging smarter today with REPSLog — wherever you work.

Please Note: REPSLog is NOT a lawyer or CPA, and this is not legal or financial advice. Please consult a qualified professional for guidance regarding IRS rules and regulations.